2025-04-10

2025-04-10

0

0

If there is one certainty about the stock market, it’s that it is never dull. In this letter, we review the three previous major market crashes to compare them with today’s downturn and assess its implications for the AI sector.

1. The COVID-19 Crash (2020)

The COVID-19 crash was one of the fastest in history, triggered by a global pandemic that halted daily life. Between February 19 and March 23, 2020, the S&P 500 dropped 34%, while the Dow fell 37% and the Nasdaq declined 27%. The S&P 500’s PE ratio fell from 18.4 to 13.6x.

However, the recovery was equally fast. Aggressive Federal easing and fiscal stimulus measures like the CARES Act helped stabilize the economy and markets. By August 2020, the S&P 500 had rebounded to new highs. This crash highlighted how structural shifts, such as the acceleration of digital transformation, can create opportunities even during crises.

2. The Great Financial Crisis (2008)

The 2008 financial crisis stemmed from collapse of the U.S. housing market, fueled by subprime mortgages and risky financial instruments like MBS. The S&P 500 lost 57% from October 2007 to March 2009, with similar declines in the Dow and Nasdaq. Valuations plummeted, with the S&P 500’s PE ratio falling from 15.5 to 9.0x.

Recovery was slow, driven by the Troubled Asset Relief Program (TARP) and unprecedented monetary easing from the Fed. By 2013, markets had fully recovered, but the impacts on labor markets and housing lingered for years. Warren Buffett famously took advantage of the downturn, investing in GS and other blue-chip companies at heavily discounted prices, reaffirming the importance of patience and a long-term perspective.

3. The Dot-Com Bubble (2000)

The dot-com bubble, fueled by speculation in internet companies, saw the Nasdaq surge over 500% as investors chased unprofitable tech startups. By March 2000, the S&P 500’s PE hit 25.4x, and the Nasdaq’s P/S ratios soared to 83.1x. In the end of the musical chair the bubble burst. Nasdaq fell 78%, the S&P 500 dropped 49%, and the Dow declined 38% between 2000 and 2002.

Recovery was slow, with the S&P 500 regaining its highs only by 2007. Investors shifted focus to value stocks in sectors like healthcare and consumer staples. From the ashes, companies like Amazon and Microsoft survived and thrived, illustrating importance of distinguishing true innovation from hype.

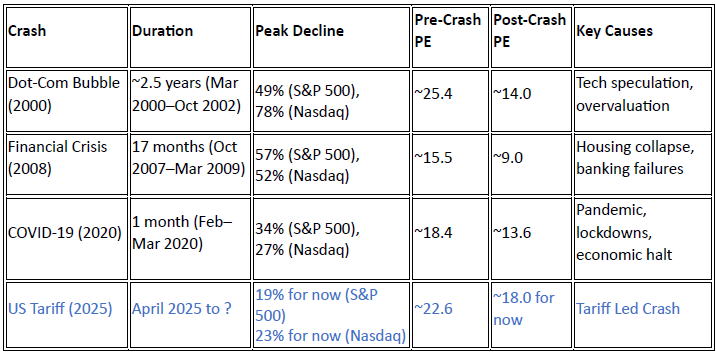

Comparative Analysis of Crashes

Our Take – We are Not “There” Yet

The last three major market crashes—the COVID-19 crash, the financial crisis, and the dot-com bubble—each highlight unique challenges, but they also demonstrate the resilience of financial markets and the importance of disciplined investing. We believe this time it will be the same, but the road will get bumpier before it gets smooth.

What trigger the crash this time?

On surface, this is due to trade tariff imposed by Trump administration. On April 2, Trump declared "Liberation Day", announcing tariffs that would affect almost all aspects of the U.S. economy. Global markets enter panic selling mode, causing the largest decline in global stock market since Covid crash.

The Dow Jones lost 4,000 points in 48 hours, the first back-to-back 1,500+ point loss in its history. Nikkei dived 8%, triggering trading halt. HSI lost 3,000 points, its largest lost ever in a single day.

All that is reversed, violently, as time of this writing, just three trading sessions and countless wreckage later, market saw the biggest rebound since WW2, S&P was up 9.5% and Nasdaq was up 12.0%, almost regaining all lost ground. The reason? Trump tweeted a pause for 90 days for tariff except for China.

The market is trading from “meme to meme”, Trump literally has the world in his palm, the finger crooking power that Roman emperors would envy. However, the idea that Trump’s impact will be limited to the goods-traded economy is also wishful thinking. Foreigners own a critical share of US Treasury debt. Continued high demand for an asset in whose issuer the world is losing trust is the difference between a Trump fire-sale and a Trump depression. And that’s truly the trillion-dollar question.

How Much More Room to Fall?

From a technical standpoint, historically, assuming no active destructive force from the govt, the past 3 bear market led to drop from 34% to 57%. To put in todays’ context, 34% down would equivalent of S&P at 4,600 level. Before today, market was down for 19%, with today’s bounce, the market needs to see another 16% downside to hit the technical bottom.

From a fundamental standpoint, the S&P forward PE stands at 20x, with consensus earning at 275, note, this is before the tariff. If Trump place 10% tariff, analyst on the street is placing 5 to 25% impact on the earnings. Let’s be generous and assume 5% impact on S&P earnings, which would put earnings at 261. With the lowest post-tariff PE reached 18x, this would lead S&P to the 4,700 level, i.e. another 14% drop.

This is largely consistent with the technical analysis, of S&P around the 4,600 range.

But that’s not the worst case scenario – in the past 3 crisis, PE contraction led to level between 10x to 15x. Again let’s be generous and assume 15x, it can lead S&P to 4,000 level, i.e., another 27% drop.

Therefore, from both technical and fundamental perspective, we are not done with the downturn. Heding has never been more important.

Implications for the AI Sector

Don't panic

Downturns are not the end of the story—they are part of a natural cycle. In fact, many of the most successful investors in history built their fortunes by taking advantage of crisis while others were paralyzed by fear. Think Warren Buffett at GFC, invested USD 5 bn in Goldman Sachs and USD 3 bn in General Electric, which yielded billions when markets recovered. Blackstone invested heavily into real estate post GFC, which led to foundation of todays success. Seqouia double down on internet post dot-com bust backing companies like Google and LinkedIn. These investments became some of the most successful in venture capital history.

AI Adoption Will Accelerate Post-Crash

Crises have a way of accelerating technological adoption. Just as the COVID drove rapid digital transformation, this crash may push businesses to adopt AI-driven solutions to improve efficiency, reduce costs, and address labor shortages. From healthcare to finance, AI’s ability to optimize processes and unlock insights will become even more critical as companies seek to do more with less.

Valuations Are Coming Back to Earth

Over the past few years, we’ve seen a frenzy of investment in “AI” companies, with valuations detached from reality. We see this crash helps to separates speculative ventures from those with sustainable business models and real-world applications. Companies focused on building robust AI infrastructure, such as NVIDIA or Alphabet on the public side, Cerebras and Groq on the private side, remain well-positioned to weather the storm.

Geopolitical Competition Will Drive Investment

Nations recognize AI as a strategic priority, and geopolitical competition will ensure sustained investment in the field. Governments are likely to increase funding for AI development, particularly in areas like defense, cybersecurity, and infrastructure optimization. This creates a tailwind for leading AI companies, for both China and US, and this time, as well as Europe.

Conclusion

This market crash is undeniably challenging, but it is also an opportunity to recalibrate and position us for the future. AI, as a transformative technology, represents one of the most compelling investment opportunities of our time.

At 3C, we adhere our investment strategy grounded from industry know-how, rigorous research and a commitment to opportunities with sustainable growth. Please feel free to reach out with any questions or to discuss our strategy further.