2025-10-24

2025-10-24

0

0

I. The Looming AI Energy Challenge: Search for the Ultimate Energy Source

Over the past two years, generative AI has advanced at unprecedented speed - from LLMs to multimodal models, and from AI coding to AI drug discovery. Yet one inconvenient truth is now impossible to ignore: AI’s power demand is compounding faster than our grids can adapt.

Data from the International Energy Agency (IEA) indicates that training a single GPT-4 level model consumes up to 240 million kWh—equivalent to the total lifecycle electricity consumption of 3,000 Tesla vehicles. Furthermore, OpenAI’s daily operational power usage rivals that of 20,000 American households.

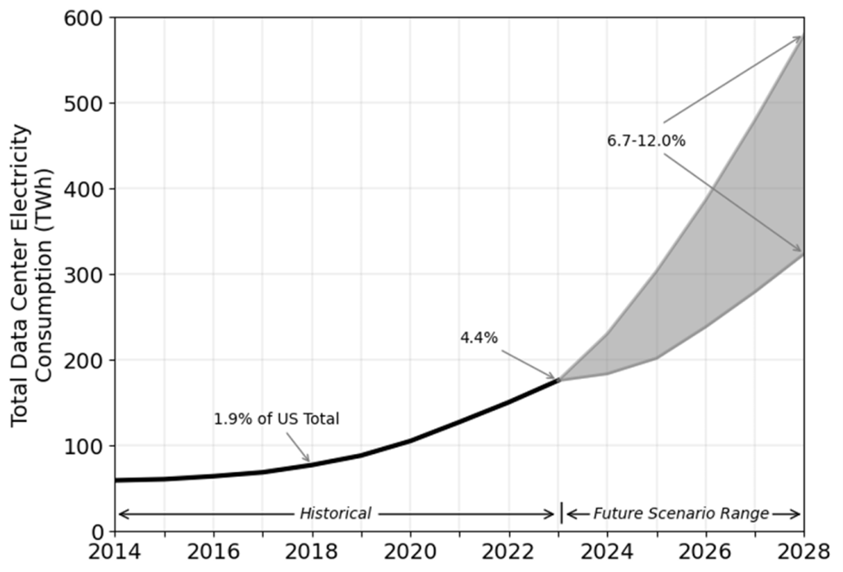

Crucially, this is only the training phase. As AI models enter the inference phase, triggered by billions of daily users, energy consumption is exploding. The U.S. Department of Energy (DOE) projects that by 2030, power demand from U.S. data centers will nearly triple, surging from approximately 4% to over 12% of total consumption. This implies that data centers alone will consume as much as the annual electricity use of the entire state of California.

US data center electricity consumption predictions (2014-2028) (Source: US DOE)

More importantly, AI does not merely need more energy; it needs better energy:

High energy density: To power enormous hyperscaler data centers.

24/7 reliability: Unaffected by day/night cycles, weather, or geography

Clean and low-carbon: To achieve the global carbon neutrality goal

Flexible deployment: Adaptable to diverse site selection and cooling requirements

Traditional energy systems are struggling to support this AI wave. Wind and solar, while clean, are limited by intermittency and storage bottlenecks. Fossil fuels, while stable, are high-carbon and inefficient. Therefore, finding an "Ultimate Energy" source that is clean, stable, and possesses ultra-high energy density has become the most urgent infrastructure challenge of the AI era.

That's where nuclear fusion comes in.

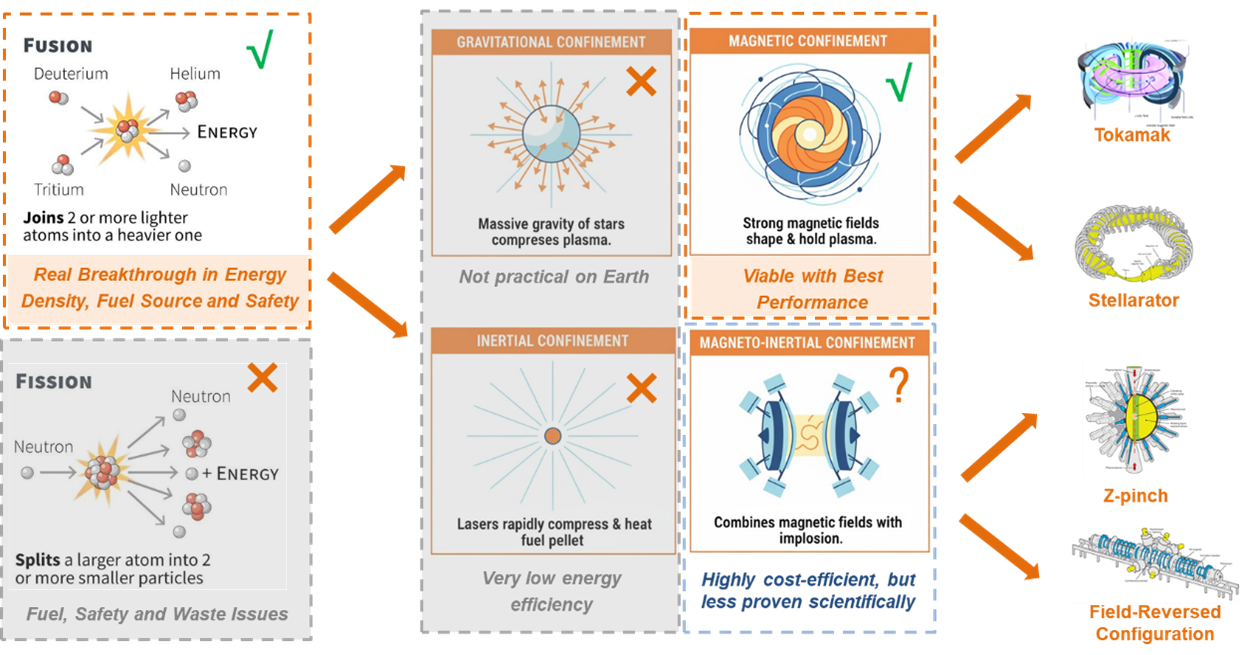

II. Fusion is the Game Changer

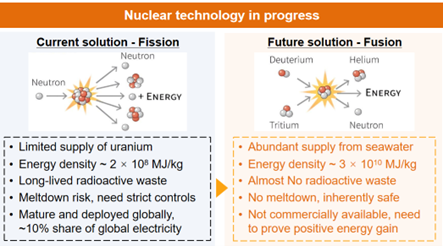

Nuclear fusion is hailed as the "Holy Grail of Energy". Its advantages are structural, not incremental vs. nuclear fission:

1. Extreme Energy Density

1 kg of fusion fuel (deuterium + tritium) releases ~3×1010 MJ — equivalent to 1,000 tons of oil or 2,000 tons of coal.

2. Abundant Resources

Deuterium can be extracted from seawater; tritium can be bred from lithium. Unlike uranium, which is finite and costly to mine, fusion fuel is inexhaustible.

3. Inherent Safety

Fusion does not rely on a chain reaction. If a malfunction occurs, the reaction simply stops. There is zero risk of a meltdown, and the primary byproducts are helium and neutrons, avoiding the issue of long-lived radioactive waste.

4. Zero Carbon Emissions

Fusion produces no CO₂, making it a truly green energy source.

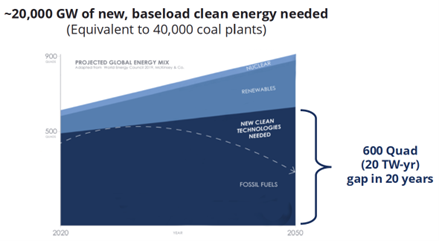

The Market Potential: A 20,000 GW Gap

According to the World Energy Council and McKinsey, the global energy structure faces a clean energy gap of 600 Quadrillion BTU (approx. 20 Terawatt-years) by 2050. Existing renewables simply cannot meet this demand alone. To fill this void, the world needs to add c.20,000 GW of clean power capacity in the next 20 years—equivalent to building 4,000 new coal plants.

(Source: World Energy Council and McKinsey & Co.)

3C's Verdict: Fusion isn't just ideal to have. It's imperative. Whoever commercializes fusion in the next two decades will control the master switch of global energy infrastructure.

III. "Fast Forward" Button Pressed: From "Always 50 Years Away" to “Commercialization in a Decade”

The old joke that "fusion is always 50 years away" is being dismantled. The technology is undergoing an acceleration revolution driven by an influx of private capital, deep integration with AI, and breakthroughs in critical hardware.

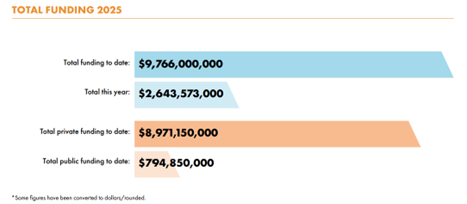

1. Private Capital Surge: From State-Led to Market-Driven

Historically, fusion was a slow, government-dominated endeavor. However, aggregated private investment has skyrocketed from US$1.9 billion by 2021 to US$9.7 billion by 2025, with US$2.6 billion raised in 2025 alone. There are now over 50 private fusion companies globally. The efficiency of commercial enterprise is compressing the timeline from “50 years forever” to 10-20 years. The new industry consensus: Commercialization by 2035.

Source: Fusion Industry Association (FIA)

2. The Tech Drivers: AI + High-Temperature Superconductors (HTS)

3C believes the surge in confidence stems from the convergence of two maturing technologies:

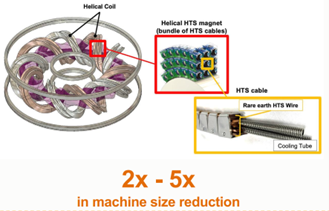

High-Temperature Superconductors (HTS)

Materials that allow for higher current density and stronger magnetic fields in smaller packages. Companies like Commonwealth Fusion Systems (CFS) and Type One Energy (T1E) are using HTS magnets to build compact, cost-effective reactors.

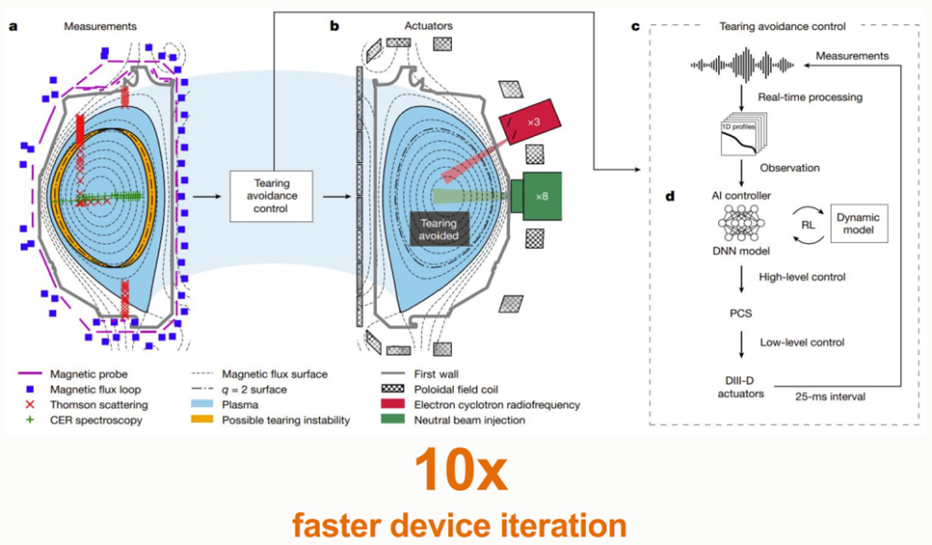

AI-Powered Plasma Control

AI in fusion research has shifted from a support tool to a core engine. Deep Learning (DL) & Reinforcement Learning (RL) are now used for plasma modeling and real-time control. For instance, the Google DeepMind and CFS collaboration on the TORAX simulator allows for real-time plasma prediction, shortening iteration cycles from years to months.

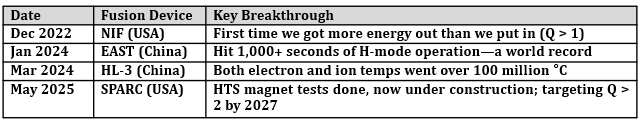

3. Scientific Validation: From Ignition to Sustained Burn

Recent breakthroughs in fusion experiments around the world have achieved both net energy gain and long-duration stable operation. These aren't just scientific projects anymore. They are proving fusion actually works and can be engineered into commercial use.

3C's Verdict: Fusion has graduated from "Scientific Dream" to "Engineering Reality." We are at the commercial inflection point.

IV. Key Nuclear Fusion Approaches – which one is the most promising?

To replicate the power of the sun on Earth, we must heat plasma to over 100 million degrees Celsius and keep it contained long enough for fusion to occur. The industry has developed different "bottles" to hold this star. While there are dozens of experimental concepts, the race has largely narrowed down to Magnetic Confinement Fusion (MCF), which uses powerful magnetic fields to trap plasma for long durations, and Magneto-Inertial Fusion (MIF), which attempts to compress plasma rapidly in pulses. Within these categories, four specific architectures have emerged as the frontrunners for commercialization.

Comparison of Mainstream Routes -

Tokamak (The "Donut"): The most mature and scientifically validated approach It uses a symmetrical, donut-shaped magnetic chamber to confine plasma.

Pros: Massive historical data and high scientific confidence; holds the records for hottest plasma and longest confinement.

Cons: Inherently prone to "disruptions"—sudden losses of plasma stability that can damage the machine. Operate in "pulses" rather than continuously, massive energy storage buffers required.

Key Players: ITER, Commonwealth Fusion Systems, Tokamak Energy

Stellarator (The "Twisted Ring"): A variation of magnetic confinement that uses complex, twisting magnetic coils to control the plasma without relying on a strong current flowing through the plasma itself.

Pros: Inherently stable with zero risk of major disruptions. capable of running in "steady-state" (24/7 continuous operation) just like a coal or gas plant.

Cons: Extremely complex geometry. Historically, these were considered impossible to design and manufacture with precision until the advent of supercomputing and AI.

Key Players: W7-X, Type One Energy, Proxima Fusion, Thea Energy

Z-Pinch (The "Lightning Bolt"): Uses a massive electrical current to create a magnetic field that rapidly compresses (pinches) a column of plasma until it fuses.

Pros: Highly compact and mechanically simpler, no massive external magnet coils needed. High energy density.

Cons: The reaction is short-lived and unstable. It requires high-frequency repetition (pulsing like an internal combustion engine) which creates significant stress on materials and electrodes.

Key Players: Zap Energy, Sandia National Labs

Field-Reversed Configuration (The "Smoke Ring"): Creates a self-contained toroidal plasma structure (like a smoke ring) that is shot into a chamber and compressed.

Pros: High efficiency of magnetic field use, allowing for compact reactors and potentially direct electricity capture without steam turbines. Advanced fuel to completely eliminate radioactive waste.

Cons: Unproven confinement scaling - Confinement times are very short, requiring rapid-fire pulsing to generate net energy.

Key Players: Helion Energy, TAE Technologies

Why Stellarator?

3C believes Stellarator is the promising architecture for the commercial energy race:

Steady-State Operation: Unlike Tokamaks or Z-Pinch devices that operate in pulses, a Stellarator can run continuously 24/7. This is non-negotiable for powering AI data centers that require "always-on" baseload power.

Intrinsic Stability: Stellarators do not suffer from "plasma disruptions." This dramatically lowers the financial risk of asset damage and reduces the complexity of safety systems.

Manufacturing Maturity: While the geometry is complex, modern 3D printing and advanced manufacturing have solved the fabrication bottlenecks that plagued the 20th century.

AI Optimization Resolved Engineering Complexity: The complex magnetic geometry, once a core challenge, is now an important asset. It is perfectly suited for AI-driven design optimization, allowing simulating billions of configurations to find the perfect magnetic trap.

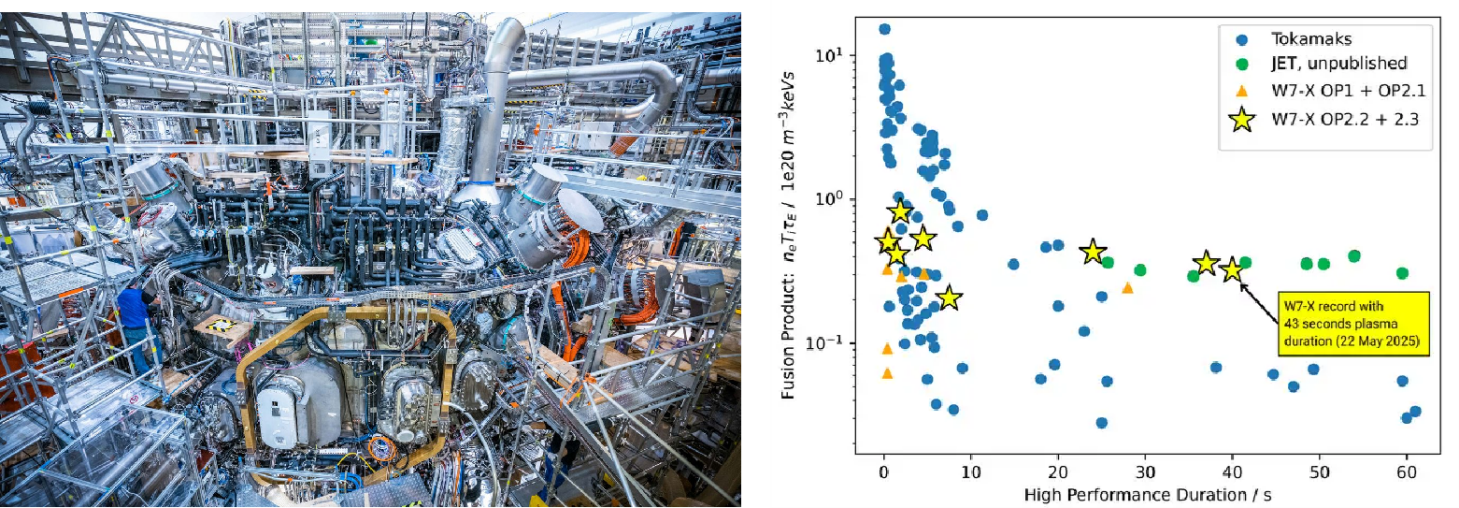

In June 2025, Germany's Wendelstein 7-X Stellarator set a world record: stable high-temperature plasma for 43 seconds with 1.3 GJ energy release, matching the performance of the JET Tokamak but with zero disruptions and no active intervention. This validated the engineering feasibility of steady-state, high-gain fusion.

The Wendelstein 7-X device and its experimental triple product data (Source: Max Planck Institute for Plasma Physics)

3C's Verdict: Stellarator is a promising fusion technology route for the goal of Commercial Baseload Power, offering the reliability and continuity required by utility grids and hyperscalers.

The coming decade of experimental results will be decisive in determining which of these fusion contenders, or perhaps a combination of their innovations, leads the transition to a fusion-powered world.

V. Why Type One Energy (T1E)?

Type One Energy is on track to build the world's first commercially-viable stellarator fusion power plant.

1. They Built World-Class Stellarators Before

The T1E team consists of the experts who built the world's leading Stellarators (HSX, W7-X). They possess unrivaled technological and operational know-how.

2. Clear Path to Commercialization

2025–2028: Construction of the prototype - the world’s first 24/7 continuous operation stellarator.

Before 2035: Operation of commercial power plant with 350 MWe grid connection.

2040+: Global fleet deployment, targeting replacement of 1,000 coal plants within 30 years.

3. Won Strategic Customer: Tennessee Valley Authority (TVA)

TVA is the biggest public utility company in the U.S., with ~35 GW of total capacity. Nuclear makes up 43% of their generation, supplying almost 10% of all U.S. nuclear energy. TVA's signed a partnership agreement with T1E to jointly build a 350 MWe commercial stellarator fusion plant.

4. Tier-1 Capital Backing

T1E is backed by Bill Gates’ Breakthrough Energy Ventures (BEV) since its Seed round. In the latest round, 3C joined as the only new investor alongside BEV and TDK Ventures, doubling down on this high-conviction bet.

(Source: Type One Energy)

VI. The Future of T1E: Pre-empting a Trillion-Dollar Market

T1E is not just a science project; it is an energy infrastructure platform of the future.

1. Massive Valuation Upside

T1E’s current valuation is significantly lower than fusion peers like CFS or Helion, despite comparable commercial progress. Its projected revenue potential exceeds that of publicly listed SMR (Small Modular Reactor) companies like NuScale or Oklo. While there is no publicly-listed nuclear fusion company at the moment, T1E can potentially be one of the first.

2. Promising Business Model

Revenue streams: Fusion Machine Sales + Operation & Management + Fuel Cycle.

Each full-scale 350 MWe power plant represents billion-dollar level EPC revenue.

Targeting replacement of 1,000 coal plants within 30 years implies massive revenue potential.

3. Strategic Significance

T1E is targeting to build one of the first commercial fusion plants, as a pioneer in the stellarator approach, establishing the global standards for manufacturing, supply chain, and operations in the AI energy era.

3C's Choice – The Direction of the Future

"We are not just investing in a technology; we are investing in the foundation of the AI era."

At 3C, we believe that true technology investment requires standing at the frontier to solve the most fundamental problems. Nuclear fusion is not only the energy answer for AI, but the next energy paradigm for human civilization.

To learn more about 3C and Type One Energy, please contact our team at hello@3cagi.vc